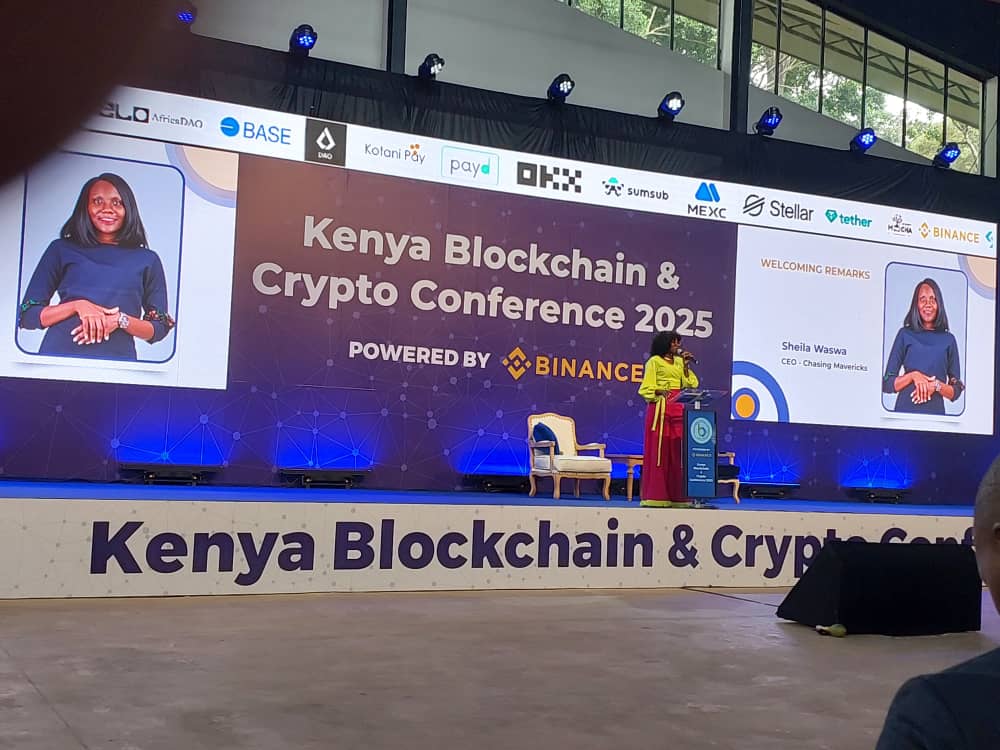

The 3rd edition of the Kenya Blockchain and Crypto Conference 2025 (KBCC 2025) took place from the 12-13th June 2025, at the A.S.K Dome in Nairobi, Kenya, under the theme “Driving Blockchain Innovation and Mass Adoption.” The conference was powered by Binance, the world’s largest crypto exchange by daily trading volumes.

The two-day conference brought together industry stakeholders from the financial services, fintechs, global exchanges, thought leaders, blockchain builders and enthusiasts, policy shapers, a broad range of professionals, Web3 companies and startups, investors, traders, and strategic and media partners.

Sheila Waswa, CEO of Chasing Mavericks, made the welcome remarks. Sheila reiterated the pillars of KBCC 2025: promoting innovation, fostering adoption through education, building collaboration and partnerships, and addressing regulatory framework challenges.

Day one of the workshop focused on institutional adoption, regulation, and blockchain for business. The focus of Day 2 was on scaling Web3 solutions. The 2-day action-packed conference witnessed several speakers and panels discussing a wide range of issues impacting the growth of the blockchain industry.

A key highlight of the conference was the anticipation within the blockchain community arising from the Virtual Asset Providers Bill, 2025, now under review by the Parliament of Kenya. The bill provides a legal framework for licensing and regulating the activities of virtual asset service providers (VASPs). The significance of this bill is that once enacted, it would become the first full regulatory framework in East Africa and serve as a benchmark Act for other regions across the continent.

The panel discussion on “The Next Frontier: How Africa is Redefining Crypto’s Future and Building Trust in the Digital Economy” highlighted the need for wide consumer education on blockchain technology to bridge the knowledge gap between key stakeholders. The panel also noted that compliance and money laundering regulations are not new and need to be aligned with the digital economy.

The panel discussing “Regulatory Landscape, Compliance and Risks in Virtual Assets” noted that the lack of regulation is slowing down innovation in the Blockchain space. The panel noted the need to balance growth and innovation, and wider consumer education on blockchain technology to bridge the knowledge gap between stakeholders. The panel also noted the importance of aligning compliance and money laundering regulations with the digital economy.

A discussion on the Hidden Risks VASPs should listed fraud, identity verification and post-KYC as risks posing challenges for (Virtual Asset Service Providers (VASPs). It was recommended that fraud detection needs to be inbuilt into every step of the VASP user’s life cycle. Artificial Intelligence (AI) was also seen to play a critical role in fighting blockchain fraud.

The panel discussing “web2 to web3 transformation” advised enterprises to engage all stakeholders early for a seamless transition. Enterprises were also advised to engage in solving real business needs. Enterprises were further advised to have the courage to experiment, for example using sandboxes. To scale their solutions, enterprises must harness the power of the blockchain ecosystem coupled with the right timing of their solutions.

On driving adoption, it was noted that Africa is a leader in P2P transactions and payments, and that blockchain technology has the potential to lower costs for cross-border payments and increase financial inclusion. Further opportunities were highlighted in the area of payment networks and payment systems.

The panel discussing “The Future of Crypto Exchanges and Digital Assets” highlighted the growth opportunities arising from mass smartphone penetration. Market research is needed to understand consumers. Crypto exchanges are looking at building long-term loyalty beyond crypto trading. Building for the long-term has increases customer loyalty. Enterprises are urged to embed their marketing strategies into their business strategies.

The conference also had several breakout sessions in which fintechs and exchanges held master classes and demos showcasing various blockchain solutions covering compliance, security, and general crypto trading.

Emphasis of day 2 of the conference was on dealing on-chain for developers and startups. East Africa is ripe for blockchain innovation with support, funding, and builder grants, incentives, partnerships, and education programs for startups and developers across various industries. The rapid growth of blockchain is outpacing talent development and has led to the integration of web3 education into academic programs.

The panel discussing “Marketing and adoption Trends in Web3” pointed out the need to communicate with local communities and to tailor blockchain communication to first-time users. To build trust, blockchain communication must also be contextual to accelerate adoption. Communication should highlight how blockchain technology will solve consumer pain points. There is a need to understand the target audience. Transparency is a must to build trust and credibility. A multi-channel approach, using channels that consumers trust, should be used to break down the complexities of the blockchain industry.

An Investor Pitch that offered direct feedback to the founders of several startups was held. The panel gave insights into the expectations of investors from startups. Investor expectations included understanding the business model, Return on Investment (ROI), Break-even point, profitability, investor exit strategy, scalability of solutions, risks, geographical barriers, and regulation. Investors were interested in knowing whether the founder would invest in the startup.

The panel discussing “Building Beyond One Chain-Interoperability and Cross-chain Development in Practice” noted that interoperability matters because interaction is needed cross-chain to pass information, send messages, and value across different chains. Building cross-chain also creates a broader audience for blockchain users. Challenges faced in building across chains include security, supporting multiple systems, and managing business overheads. Other challenges include blockchain trade-offs and potential loss of network features. To manage these challenges, developers were requested to engage in extensive research while selecting the chains to use, consider the resources offered by the blockchain, and the quality of the development team. Developers were cautioned against re-inventing the wheel, and advised to keep themselves up-to-date with the latest developments in blockchain technology. Developers were advised to use open-source code and to utilize existing Software Development Kits (SDKs).

The panel discussing “Builders and Chains-Bridging Expectations” delved into the need for chains to retain developers after hackathons. Developers requested mentors for to winning teams in hackathons.

Developers requested that the chains offer more predictable career paths after onboarding. Developers encouraged chains to have local representation and to invest in the local blockchain ecosystem. Chains requested developers to have more intent, be open-minded, and persevere.

The panel discussing “From Code to Product” advised developers to avoid rushing into commercialization before their products were fully functional. Developers need to understand the core infrastructure of their products. Developers were also cautioned against over-engineering their products and to evaluate whether their solutions were essential or nice-to-have.

The conference ended with a call for all stakeholders to engage deeply to ensure faster and seamless blockchain adoption.

Acknowledgment goes to all speakers and panelists at KBCC 2025

Article by: Isa Nsereko (Blockchain Writer and Developer) X: @isansereko